Otis | Alternative Investments

Context

As a young person that hasn't exited a company and doesn't make enough money to be considered an accredited investor, the barrier to entry into particular asset classes remain prohibitive. Generally, if I want to invest and grow money, I resort to public stocks and cryptocurrencies. However, there's an array of other asset classes that I would like to participate in, ones that allow me to get some skin in the same game as wealthy individuals and institutional investors.

Overview

Otis is a marketplace that allows anyone to invest in alternative assets. They're deeply driven by making wealth accumulation and preservation possible for the 99%. People like myself will be able to invest in things like fine art, commercial real estate, movies, and even sneakers, all for as little as $100.

Here's how it works, Otis:

Finds and picks an asset

Acquires the asset

Securitizes the asset, converting it into purchasable shares for investors

All of the assets are owned by Otis Gallery LLC, a subsidiary of Otis. When a person purchases shares in a specific asset, they become a shareholder in a sub company that represents the asset.

As you might imagine, shares can be bought and sold on their secondary market, allowing seamless trading between different assets. Otis plans to hold onto each asset for about 5-10 years, and at any point, anyone can offer to acquire the asset in full, liquidating all the investors.

Pricing

In regards to fees, Otis is still working out a structure that will be economically feasible for everyone

Team

Otis was founded by Michael Karnjanaprakorn. Before Otis, Michael co-founded SkillShare, an online learning community for creators. Skillshare went on to raise $50M+ and reached 6.5M members. Before SkillShare, Michael led the product team at Hot Potato (acquired by Facebook) and was an early employee at Behance before its acquisition by Adobe.

In addition to Michael, the team is comprised of Connor Lin (Biz Dev),

Andrew Simpson (Growth), and James Gilligan (Ops). Conner co-founded Carbon-12 Labs, a price-stable cryptocurrency designed to create a more efficient and inclusive global economy. Andrew founded Someonew, a platform for employees of large companies to connect better. James was Head of Ops at CommonBond, an online lending platform that takes the trouble out of education financing.

Market + Opportunity

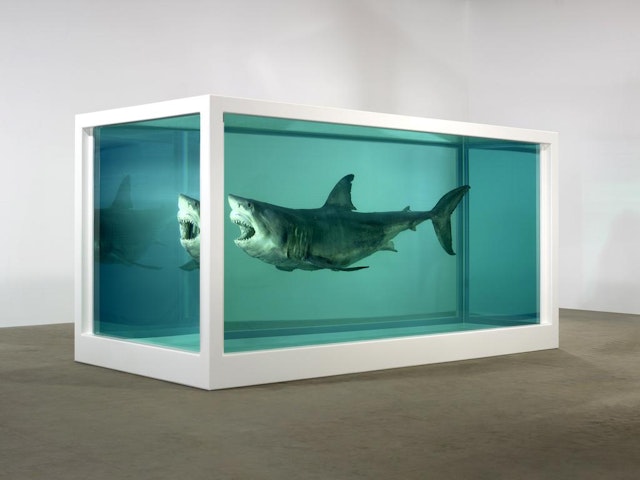

Otis plans to offer a diverse set of assets to invest in but they're going to kick everything off with Contemporary Art — work made and produced by artists living today. Contemporary art is widely known for artists being able to explore different mediums and reflect on modern day society through their work.

Here are some examples:

Contemporary art isn't just aesthetically pleasing; it plays a huge role in the $63.7B global fine art market. In 2017, post-war and contemporary art was the largest sector of the fine art auction market, representing $6.2B in sales and accounted for 46% of its total value. I should also mention that sales have been increasing 12% YoY.

In a winner-take-all market like contemporary art, accessibility is limited to the wealthy. In fact, works priced over $1M accounted for 62% of value in the post-war and contemporary art sector. If 61% of people don't have enough money in their savings to cover a $1k emergency, they definitely don't have enough to acquire a piece from an established artist. On the other hand, it may still be lucrative to invest say $100k in ten works than to invest $1M in one work.

Although works are selling at massive prices, according to a survey, art dealers are having trouble finding new buyers and new demand for art and antiques. In addition to this, there's a significantly low number of galleries being established, the number of new galleries created in 2017 was about 87% less than in 2007.

Though this is just a subset of Otis's grandiose vision, I believe there is a huge opportunity here to genuinely help the 99%, dealers, and creatives alike.

Competition

Masterworks

Masterworks is identical in that they want to make it possible for everyone to invest in blue-chip art. However, Masterworks has a rather steep entry point of $1000 versus Otis's $100 entry point. In addition to this, Masterworks focuses on acquiring only "bluechip art" which typically cost well north of $1M, and artist are already considered established. Comparatively, Otis plans to be more flexible in art acquisition price and artist categories. Because Masterworks acquires art at such exorbitant prices, they have to work directly with major auction houses, whereas Otis has the option to acquire work from art dealers, online, and at some point, even the artist.

Rally Rd.

Rally Rd. is also a company that allows people to purchase shares in blue-chip items, except they're in the market of classic cars. Though, I don't necessarily see Rally Rd. as a direct competitor, they can expand their offerings at any point, or Otis can decide to add classic cars to their palette of assets.

Arthena

Arthena is a "quantitative investment firm for art assets" — meaning they host various funds for people to buy into, where the assets are chosen using a data-driven approach. Arthena can be seen as a competitor because they are an alternative method for people to use when investing in art. Nonetheless, there are some drawbacks: 1) you can't purchase shares in individual works, 2) you must be an accredited investor, and 3) buy-in minimums are around $10k — this is fortunately not the case with Otis.

What makes Otis different?

Otis offers a variety of assets meaning they aren't constrained to one offering. By doing this, they will provide investors with the flexibility to explore different assets that pique personal interest, have a high barrier to entry, and historically perform well, things that are not typically mutually exclusive.

Otis is potentially opening up an alternative route for creatives to take ownership of and monetize their work. Typically, an artist has to go through dealers, gallerist, etc. but with Otis, they can have their work acquired and let the market decide ¯\_(ツ)_/¯. I could see this working with an emerging artist, but it's unclear how this will work with mid-career and established artist.

Qs (Art an an Asset)

How will Otis find undervalued works by reputable artist (can their algorithms do that?)

What level work do they plan on acquiring? Emerging, Mid-Career, or Established, or all?

How does Otis plan on educating users who know nothing about this market but want to participate?